Table of Content

Weight your options carefully, but be sure to give a lot of consideration to VA home loans. Closing Costs - There are certain fees and expenses that the seller cannot pay when a VA home loan is being used to purchase a house. For instance, courier fees and document recording costs are generally the responsibility of the buyer. Although they aren't usually terribly expensive, they should still be taken into consideration when calculating how much you can afford to spend. Also, miscellaneous VA loan fees are going to be your responsibility, as is the cost of termite inspections - if they are required.

You are a surviving spouse who has not remarried after the death of a veteran while in service or from a service-connected disability. Those whose spouses are missing in action or prisoners of war may also apply.

What Determines My Rate?

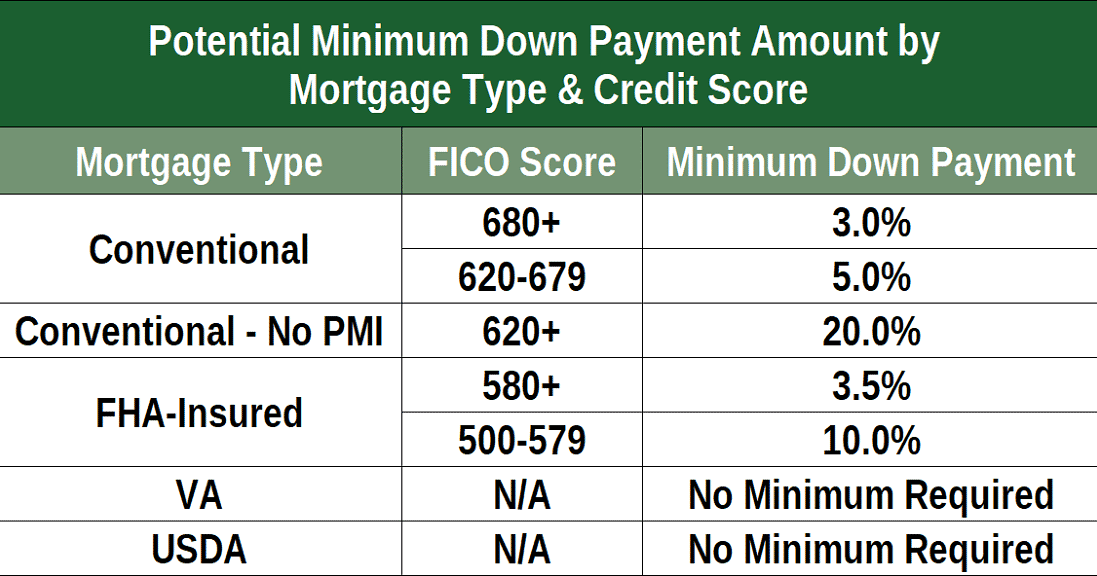

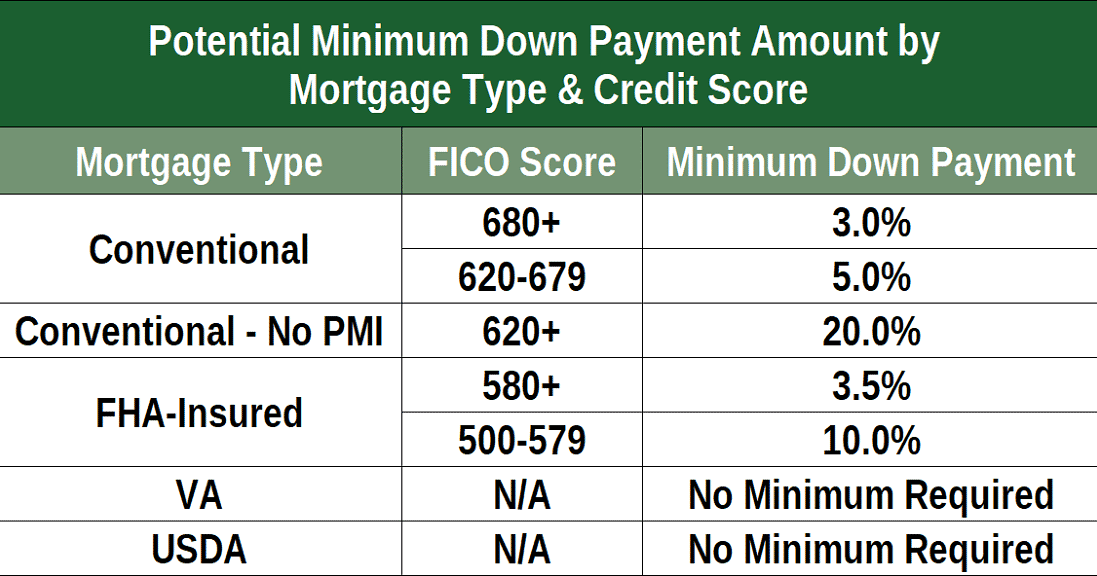

FHAs typically have more flexible credit score requirements than VA loans, with the minimum FICO requirement for an FHA loan being 580 instead of 660. However, VA loans are still more lenient in terms of eligibility requirements, such as bankruptcies and short sales. If you’re looking to buy a home but don’t want to make a down payment or pay for private mortgage insurance, it may be the right time to use a VA loan. Pentagon Federal Credit Union’s current 30-year and 15-year VA mortgage rates are 2.5% and 2.750% respectively. APR rates for 30-year loans are offered as low as 2.631%, while the 15-year loan APR is offered as low as 2.997%. Quicken Loans provides the best online experience for military members seeking a more self-service approach to banking, with available access to live mortgage experts when needed.

Other lenders' terms are gathered by Bankrate through its own research of available mortgage loan terms and that information is displayed in our rate table for applicable criteria. The overwhelming majority of service members and veterans receive lower interest rates with the VA home loan program over traditional mortgages. This is thanks to the financial backing given by the Department of Veterans Affairs as the loan guarantor, which allows lenders to assume less risk and in turn, provide lower interest rates. VA refinance rates are often different than rates on VA purchase loans. The type of VA refinance loan, the borrower's credit score, the loan-to-value ratio, and other factors can all play a role in VA refinance rates. On average, VA loan rates are typically lower than both FHA and conventional mortgage rates.

Jul VA Loan Rates

Their underwriters are going to want to look over the loan as well as know your estimated closing date. Points are generally more advantageous to borrowers who plan to own the home for a longer period of time. Your loan officer can help you determine the break-even point of purchasing discount points, or if points even make sense for your specific situation.

Are any of your balances higher than 30% of that card’s credit limit? This offers the best bang for your buck in determining your mortgage rate. This is because you’re boosting your credit score and reducing your DTI at the same time. While it is a commonly-held belief that VA loans have lower interest rates than conventional loans, that’s not necessarily true. Financial institutions that cater to veterans and active-duty personnel may offer lower interest rates compared to conventional loans. So it’s important who you chose as a lender and to shop around at the outset.

Current Mortgage and Refinance Rates

Some lenders try to entice borrowers with unbelievably low rates that are nearly impossible to qualify for. We'll work within your financial means and give you an accurate and realistic quote. Borrowers have the option to buy down their interest rate by purchasing discount points. When you purchase discount points, you are essentially paying interest upfront to receive a lower rate over the life the loan.

Carly Severino is a freelance copywriter and editor with more than 15 years of writing experience, and is the current founder of Word Nerd Writing & Editing Services. Specializing in content marketing and SEO, she is adept at helping businesses meet their objectives through strategic planning and flawless copy. An FHA loan, also known as a Federal Housing Administration loan, is another form of mortgage loan backed by the U.S. government. However, there are some differences between FHA and VA loans to consider.

What types of VA refinance loans are available?

However, rates are still very good for most borrowers with credit scores of 620 or greater. Be sure you understand the requirements for qualification with each lender before you apply. Low interest rates and flexible lending requirements are just a few of the benefits military families can enjoy when choosing a VA loan.

If you are a reservist or a member of the guard, please change this variable to reflect your funding fee. At NextAdvisor we’re firm believers in transparency and editorial independence. Editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by our partners. Editorial content from NextAdvisor is separate from TIME editorial content and is created by a different team of writers and editors. 30-year fixed mortgage, a 30-year VA loan has some distinct advantages and disadvantages. Conventional mortgage, the waiting period is at least twice as long.

Instead, Mr. Banning provided a refinance of $1.62 million with no additional money down. If you meet the military service requirement to qualify for a VA loan, it can be an excellent option. But depending on your personal financial situation you may find that even if you’re eligible for a VA loan, it’s not the best deal for you. Closing costs on a mortgage refinance typically range from 2% to 6% of the home principal balance but varies based on your credit score and loan size, program and term.

In a rising-rate environment, it’s especially important to consider how much you could save by refinancing. VA refinance loans are only available to current or former military members and their spouses, and they have lower interest rates, fees and income requirements. The best mortgage rate for you will depend on your financial situation. In addition to their VA mortgage loans, Navy Federal Credit Union offers a host of additional services that other lenders do not. The Freedom Lock program from NFCU allows military members and veterans to lock in their interest rates on their loans, regardless of whether or not rates increase. What’s unusual is that with this program, customers can readjust their VA home loan rates to the lower rate at no additional cost if interest rates decrease.

One of the biggest worries that prospective home buyers have is paying hidden fees. When figuring out how much you can afford, you need to make sure that you take every single fee and expense into account. Many mortgage programs and home loan products have hidden fees; on the outset, they aren't very obvious.

If you want to see how a VA loan can benefit you and your family, be sure to check out our helpful mortgage calculator. Additionally, a VA loan must be used on your primary residence and may carry additional fees if it’s not the first time you’ve used it. VA loans also carry a maximum loan amount that changes each year, which may limit the options available if you’re planning to buy a more expensive home. Currently, Quicken Loans offers 30-year, 25-year, and 15-year fixed VA loans with VA home loan rates of 3.75%, 3.75% and 3.125%, respectively. The APR for 30-year, 25-year and 15-year fixed loans is 4.21%, 4.282% and 3.931%, respectively. Veterans United offers 30-year and 15-year fixed loan options with competitive APR percentages and touts high rates of customer satisfaction.

No comments:

Post a Comment